Mike Simonsen

Mike Simonsen is the founder and president of real estate analytics firm Altos Research, which has provided national and local real estate data to financial institutions, real estate professionals, and investors across the country for more than 15 years. An expert trendspotter, Mike uses Altos data to identify market shifts months before they hit the headlines.

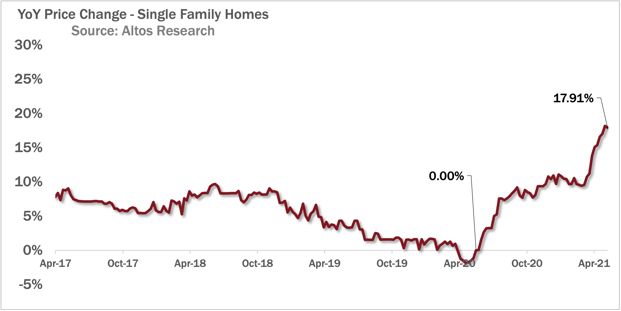

Home prices have risen 18% in a single year. Even as the median home price in the US pushes $400,000, 25% percent of all homes that came to market across the country last week were sold within hours of listing. Bidding wars and sales-over-asking are so extreme that appraisers are having a difficult time certifying that many houses are actually worth what the market just extracted.

This is certainly a scorching-hot real estate market. But is it a real estate bubble?

Here are 10 bubble signals to watch, which signals we're seeing at the moment, and what to watch for.

(Make sure to subscribe to our YouTube channel for weekly updates on these signals!)

10 Signs of a Housing Market Bubble

1. Rapidly rising home prices: YES.

You can't have a market bubble without skyrocketing values - and we have skyrocketing values. Home prices are 18% higher than last year at this time. Home prices rising that quickly are not healthy. Home buyers are forced to make impulsive and potentially dangerous decisions. If we look at price changes alone, it's sure feels like a bubble. But there are more factors to consider.

2. "Have to get in" mentality: YES.

It has been a remarkably advantageous year to be a homeowner in America, and renters have missed trillions in equity gains. Many of them are feeling the pressure to get in before they miss out more. That pressure is driving much of the madness in bidding wars and in exurban markets that gained favor during the work-from-home period. The FOMO is real!

3. Investor frenzy: YES.

The market-disrupting phenomenon of the iBuyers - companies that simplify the risks and scares of the home selling process by promising to purchase a home in just a couple days - were made possible by giant piles of cheap money. Hundreds of me-too players have crowded the iBuyer industry in the last five years. These companies compete with individual buyers.

But the investor frenzy isn't limited to institutional players. Individual investors own the vast majority of single family rental properties, and cheap mortgage rates incentivizes these investors too. When a mortgage is 2.75%, a homeowner often chooses to buy the new home and keep the old home for investment income. That income promises to be strong forever with a fixed rate loan.

Investors have taken 8 million homes from the resale market into rental market - shrinking our available supply. Without a doubt we have investor frenzy right now.

4. Poor affordability: MAYBE.

As home prices rise, homes become less affordable, right? Not necessarily. Affordability in terms of monthly payments improves as mortgage rates fall. All time low rates mean homes are roughly as affordable right now as they have been in recent years. This changes rapidly if rates rise, and is the next of the signals to flip in our bubble watch. Right now, it's not in bubble territory.

5. Frauds & scams: NO.

If you were around in the last time, 2006-8, you're familiar with "liar loans", or "Ninja loans" where using only the borrower's stated income. These mortgages, while being perhaps legal, were vaguely fraudulent. Borrowers were promising that they had income when they didn't have it. Much of the purchase demand in the bubble was fraudulent. At the same time, there were appraisal frauds happening. As a market moves from "hot" into bubble, that brings out the fraudulent behavior - quick buck and scam artists. And we frankly don't see much of that activity right now in this market. Certainly the mortgage market fraud is very low.

But if you as a participant in the industry start seeing things that look suspect or outright fraudulent, those are signals that the bubble is forming.

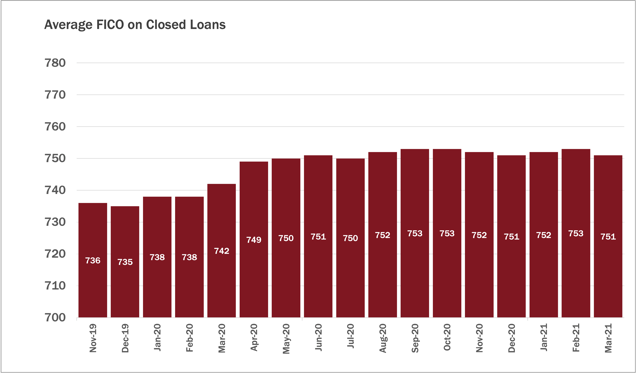

6. Weak underwriting: NO.

When it's easy to get a loan, or it's easy to make decisions on purchases, then it's more likely that we see bad underwriting decisions being made. And right now that's not happening. Borrower FICO scores are at record high levels and have climbed during the pandemic. Buyers now are well-financed and have strong credit.

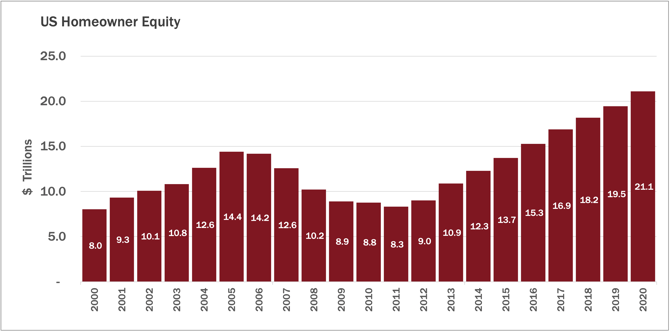

7. Decreasing equity via cash-out: NO.

If you've paid attention to the headlines recently you'll know that home equity is rising. Recently Americans been doing more cash out refinances - using the house as a piggy bank. What's distinctive is that in the previous bubble in 2006, cash-out refinances were taking equity off the table. Homeowner equity was decreasing; Americans were going further into debt.

Now, the opposite is true. Even after factoring in cash-out refinances this year, equity is climbing in the home. Americans have a lower debt-to-equity ratio than they did a year ago.

8. Rising inventory / falling sales: NO.

Available inventory of homes for sale is at record low levels. There are 57% fewer homes on the market than a year ago, and that was already record low levels. Inventory is finally starting to tick up. But for a bubble to burst, supply must be bigger than demand. There are several factors conspiring to keep inventory low for many years, including the fact that existing homeowners have very low costs, and that the largest demographic wave of homebuyers ever, the Millennials, is upon us. When rates climb substantially, we'll start to see more inventory become available. But the signals imply that may be years away from now.

9. Increasing Days on Market: NO.

In 2008 and 2009, we could correlate the default rate in a zip code with the Days on Market (DoM) for the active listings there. It turns out that time to sell is a powerful signal for consumers on whether to default on their mortgage. If I'm in a bad deal, and I think I'll never be able to sell my home to get out of that deal, I default on my loan. Right now, the time to sell a home is a record low levels. The second quarter of the year is peak demand time and DoM should be at its lowest. The bubble-bursting signal here will be when Days on Market climbs in a counter-seasonal trend. Next summer if DoM climbs when it should be falling, that's the market's signal of overheating.

10. Big interest rate spikes: NO.

In many ways, our record low interest rates are driving this crazy market and everything on this list. When rates rise, we should see inventory climb, days on market climb and affordability weaken. But if price appreciation doesn't recede and bidding wars don't cease, then that implies that other factors like irrational demand, or fraud, have taken over as the dominant factors. That will be a bubble signal indeed.

As fast as things are moving, your buyers need to be prepared to act quickly and decisively. Make sure you're arming them with Altos data.