Mike Simonsen

Mike Simonsen is the founder and president of real estate analytics firm Altos Research, which has provided national and local real estate data to financial institutions, real estate professionals, and investors across the country for more than 15 years. An expert trendspotter, Mike uses Altos data to identify market shifts months before they hit the headlines.

Inventory is rising more rapidly than any recent July. But the pace of increase has actually slowed since June. This is the third week in a row for 3% inventory gains, down from 6-8% over the last few months. Those are early signals for home buyers and sellers to expect restricted inventory for the near future. We’re off the record lows, but the trajectory doesn’t look like we’ll get back to normal levels of 1 million single family homes soon. We’ll share more details in this week’s Altos Research real estate market update.

Every week Altos Research tracks every home for sale in the country. We analyze all the pricing, supply and demand, and all the changes in that data and we make it available to you before you see it in the traditional channels. If you aren’t using Altos market reports with your clients, your buyers and sellers, now might be the time to step up. Go to AltosResearch.com and book a free consult with our team. Because everyone is worried about what’s happening right now. They need you to help them see clearly.

I’m Mike Simonsen, I’m the CEO of Altos Research. Here’s what we’re looking at for the week of July 25 2022.

Special note: next Monday, August 1st, I’ll be traveling and will be unable to produce the video. I have a couple trips before the summer ends so we’ll have to skip them.

The next Altos Top of Mind Podcast will be available on Wednesday August 3, with Kevin Oakley. We’re talking all things new construction. What’s happening with buyers for those homes and how that’ll impact inventory this fall. Great conversation. Then back with regular programming on August 8th.

Inventory

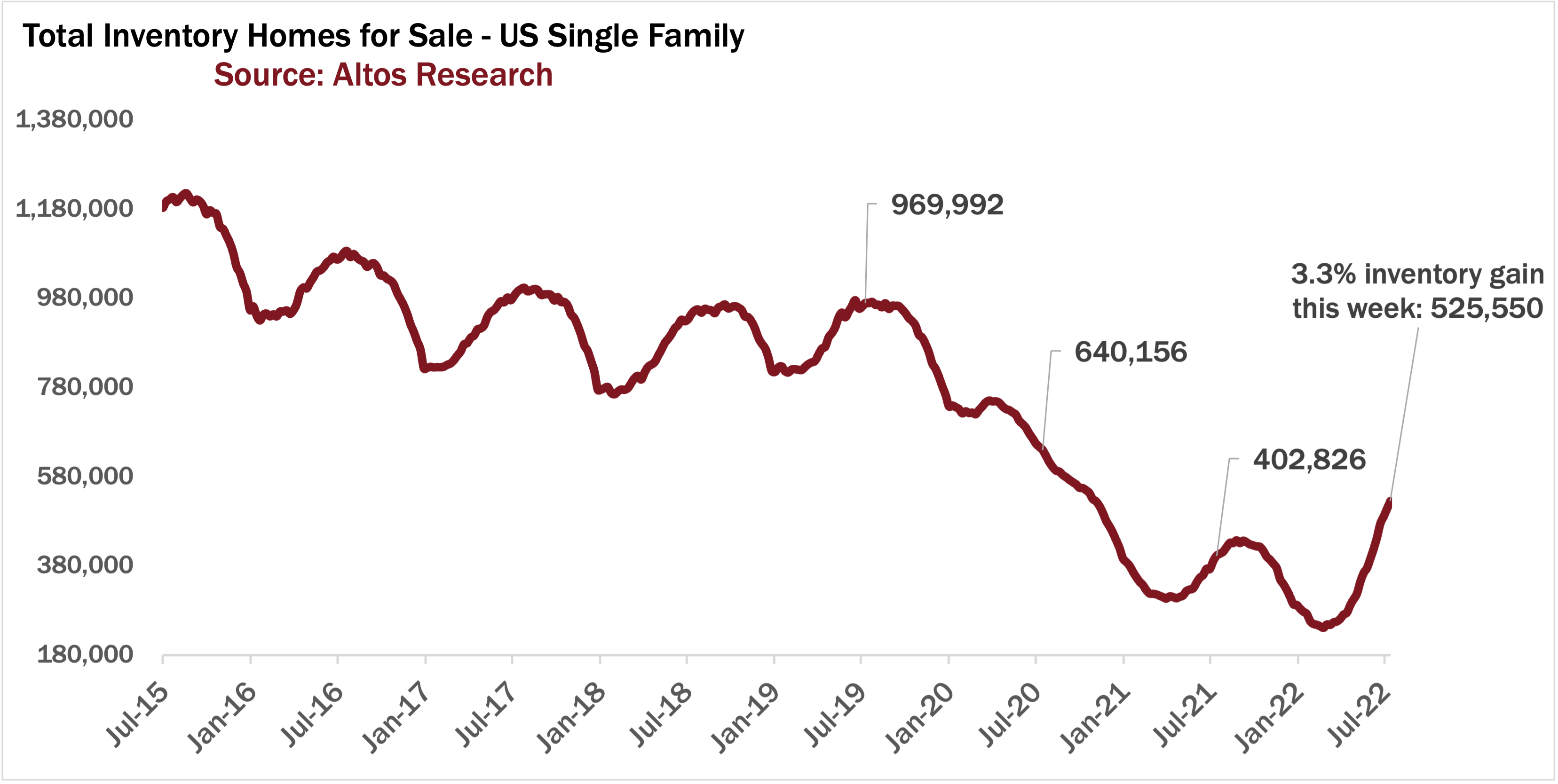

OK Inventory. Available inventory of unsold single family homes grew by 3.3% this week to 525,000 homes on the market. If your neighborhood is like mine, you’ll see the difference lately with yard signs popping up like dandelions.

You can see the history, we have 30% more inventory than last year at this time when we had just over 400,000 homes on the market, but still fewer homes available than 2020 at the start of the pandemic when we had 640,000 homes, and still 40% fewer than 2019.

Our current forecast model projects that the year will peak with over 600,000 homes on the market and end the year at about 535,000. If the economy tanks, we could see significantly more than that. But it’s still hard for me to see us getting back to normal levels of inventory, which would be 1 million homes on the market, unless we have a really deep job-loss recession. The rate of inventory gains is slowing down now each week.

In June we were adding 6-8% inventory weekly, and now we’re adding closer to 3%. That’s still a lot for July. But it’s slower than it has been and the trajectory looks to be turning the corner for a peak in September or October before receding for the holidays.

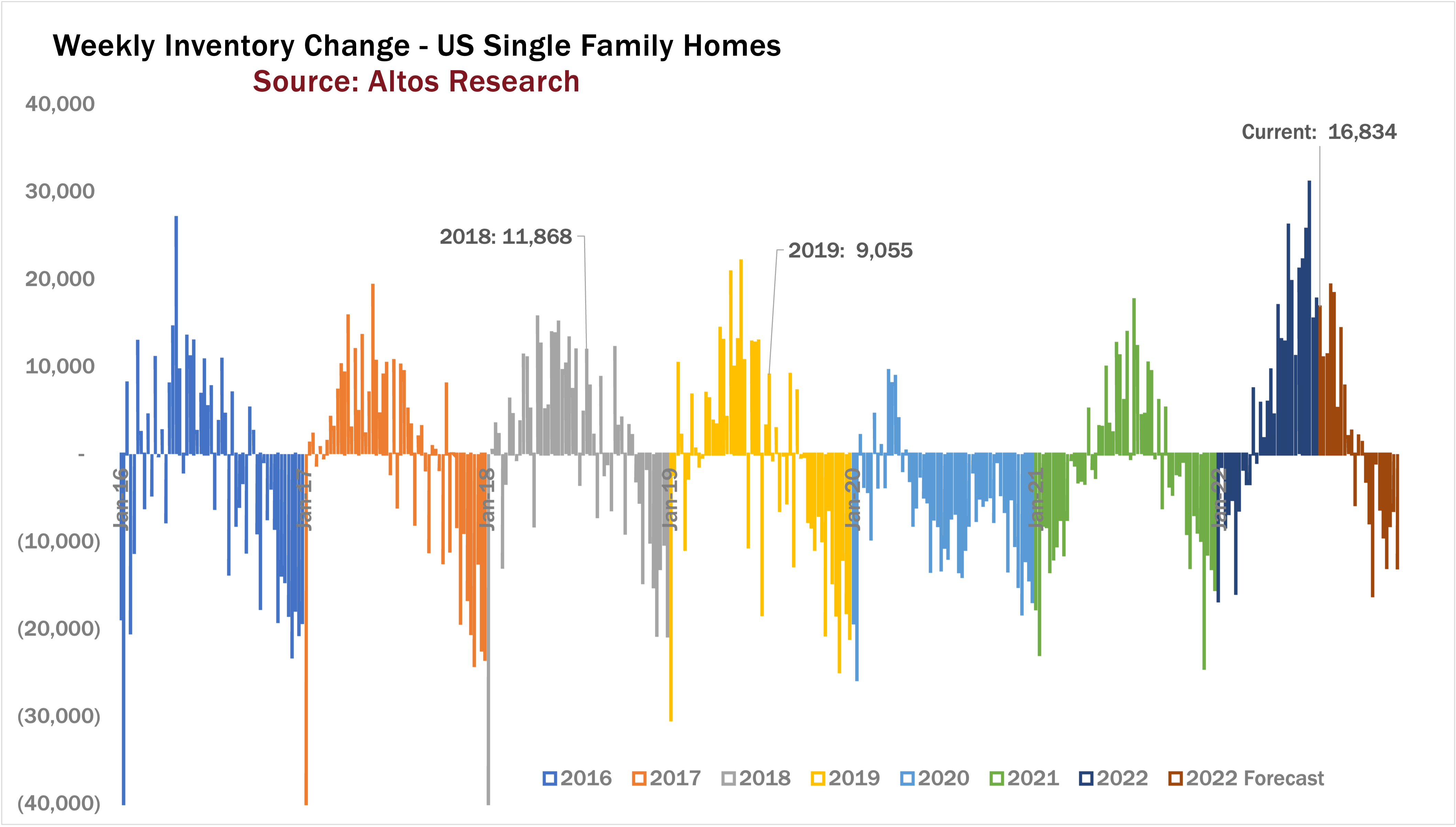

In fact if we look at the weekly changes in inventory, we can see how that forecast probably plays out. Each color here is a year. The bars above the line are weeks when inventory gained, below the line are when inventory declined in that week.

You can see the dark blue at the far right of the chart has bigger spikes than we’ve seen in years. In the last three weeks though inventory gains have receded a bit. The brown is the forecast week by week for the rest of the year. You can see we have 5-6 weeks of pretty big inventory gains. I’ve highlighted this third week of July back in 2018 and 2019 too. See we’d normally add maybe 10,000 homes and this week we added 16,000.

For inventory to end the year over 600,000 say, we’d have to have record breaking weeks forthcoming, or not have the seasonal decline over the holidays. Those both seem possible but unlikely. Maybe I’m an optimist, but that’s how it looks.

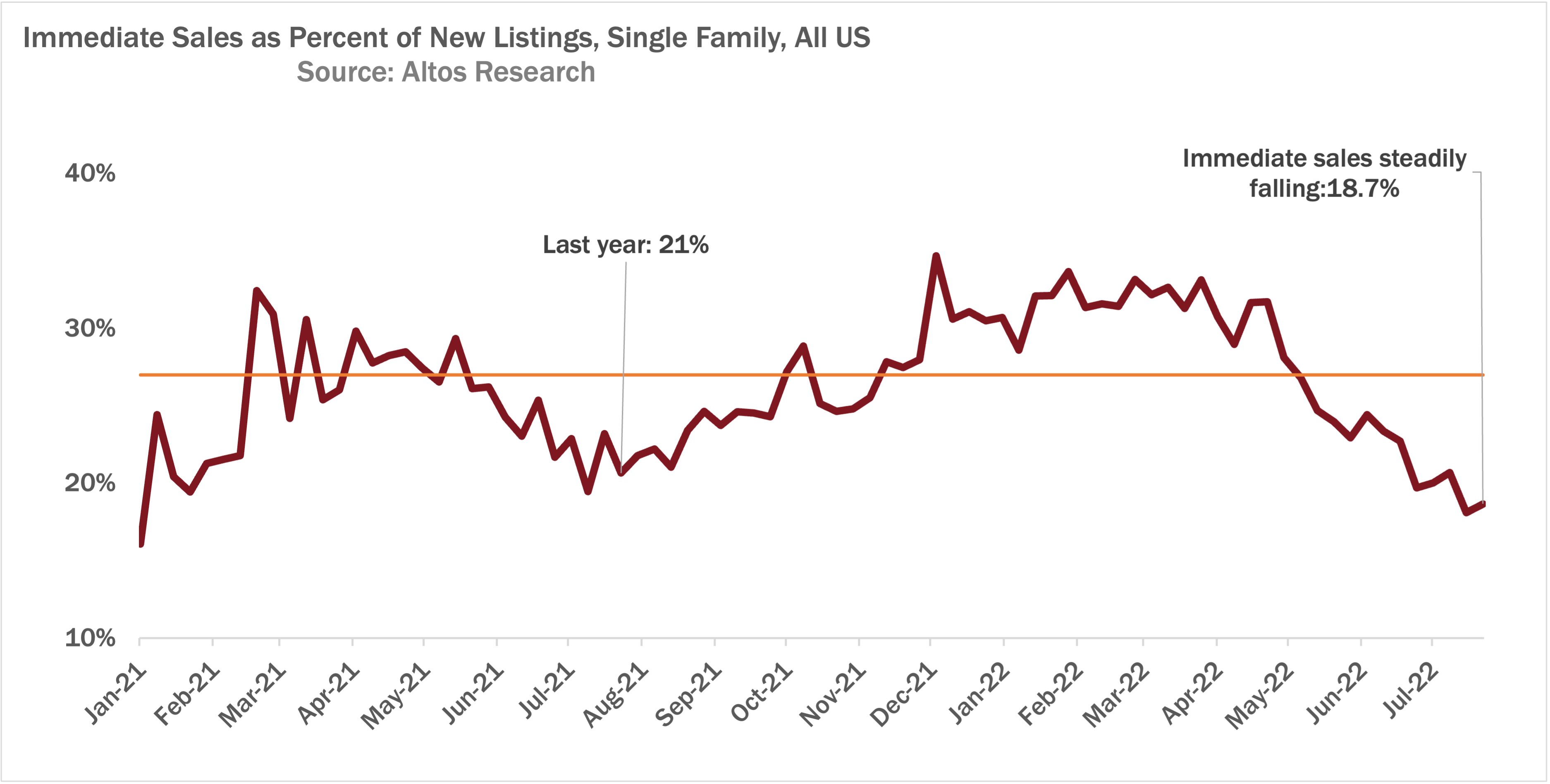

So if you have buyers sitting on the sidelines, this implies that yes, they’ll have a little more selection, but it doesn’t look like it’ll be a ton. It seems unlikely that bargains are going to suddenly show up. We have fewer bidding wars. So that’s great for buyers.

But you know those hoping to be vultures to scoop up deals from distressed sellers seems unlikely to have great opportunity. Maybe some.

Speaking of bidding wars, that’s one place you really see the impact of higher mortgage rates. When rates are 3% if you have to over bid on a house by a 100 grand, that only changes your payment by a few hundred dollars per month. But at 5.5% that payment change is really notable. So those bidding wars are the first to change.

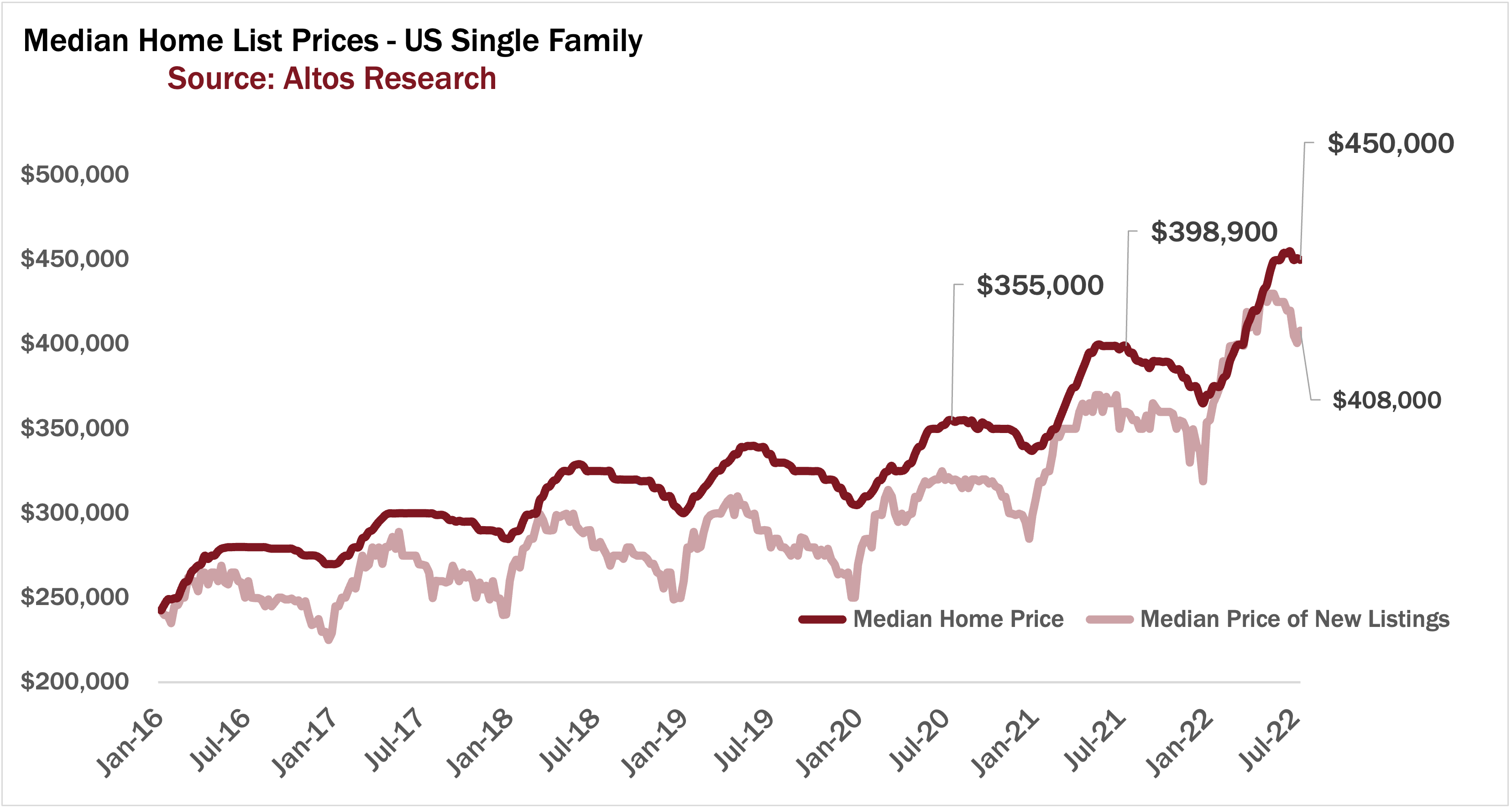

Median Market Price

As a result though, the median market price for homes is staying relatively stable. The median home price in the US this week is $450,000. That’s down just a fraction of a percent from last week. As rates rise the marginal bidding war ceases but the ask price stays pretty flat so far.

Because home prices are up 12% from last year at this time, that’s another signal that there are likely be very few distressed sellers any time soon. It implies to me that sellers seeing a soft market simply will hold longer. I suppose that changes if we see a big economic drop.

The median price of the newly listed cohort rose to $408,000 this week. This is encouraging. I’ve been on the lookout for signs that the market is tanks fast. And one place we’d see that is in the price of the new listings. As homes start to sit on the market longer, we can see this happening in the areas like Boise, Austin, Salt Lake, especially at the high end, homes over $1 million as they sit longer, we’ll see price reductions in the active market, we’ll see the median price of the new listing start to discount back a bit.

And if that’s a lot then future transaction prices will decline too. As of right now the discounting in the price of the new listings is more seasonal than anything special in a slowing real estate market.

Price Reductions

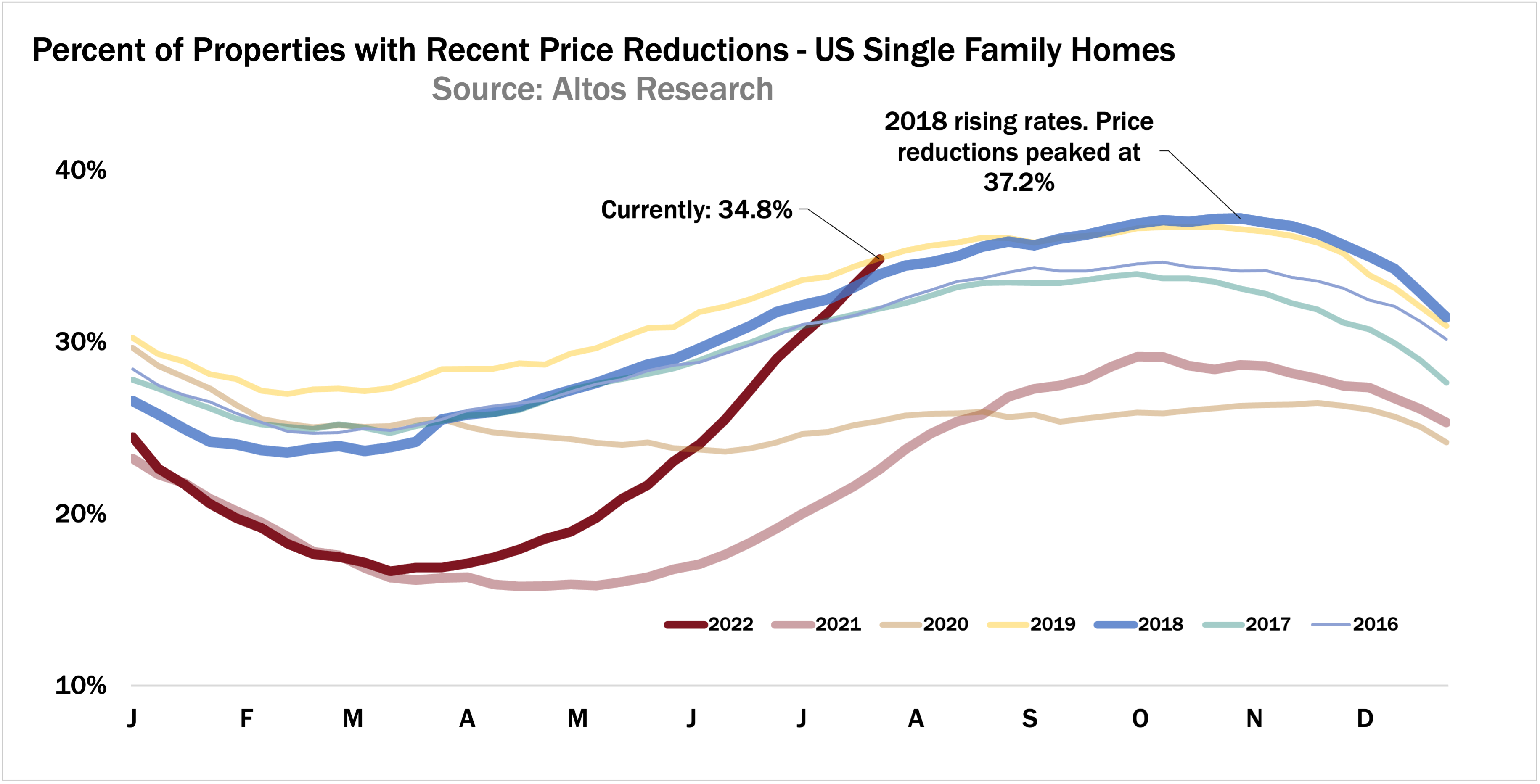

But of course we do see price reductions climbing. When the homes sit on the market for longer than expected they need to discount. This will continue through the end of the summer. If you listed your house in June and didn’t get any takers, you’re now starting to adjust to find buyers.

Currently 34.8% of the homes on the market have taken a price cut. Price cuts are still rising steeply each week and only maybe have slowed just a touch. Next week we’ll be at the most price reductions in several years. By the end of the summer we’ll have 40% of the market with price cuts. See the dark red line here is just about to break above the trends of the last 6 or 7 years.

This is why sellers right now need to be well informed. You don’t want to risk being over priced at this moment. There are only going to be more competition and more price reductions for the rest of the summer. Don’t get behind this curve. With 2018 as a guide you can imagine that price reductions peak in late October before the holiday reset. Long way to go on these price adjustments.

If you need to have these types of conversations with your buyers and sellers right now, you should go to AltosResearch.com and sign up to get the data in your hand and in their hands today. Local data for every zip code in the country. This market is moving so quickly, they need you to be their voice of expertise, right now. Join us at AltosResearch.com

That’s all the data we have time for this week. Next week is an off week for me. No video. Altos subscribers of course get their data right on schedule. Back August 8 with the latest. Hit the subscribe button on the YouTube channel so you don’t miss any of the data as soon as it comes out! See you in two weeks.